In the Ministerial Statement made by DPM Heng Swee Keat on Mon, 5 Oct 2020, he stated that there will be an extended and enhanced support for firms and workers.

Companies looking to grow their businesses, increase productivity or expand overseas will soon be able to tap bigger grants and expanded loan schemes. These moves will provide more support for businesses during the Covid-19 pandemic and help them to transform, Trade and Industry Minister Chan Chun Sing said as he announced the enhancements to several grant and loan schemes on Monday, Oct 12.

Market Readiness Assistance Grant

This grant provides Small and Medium Enterprises (SMEs) with financial assistance to help take your business overseas. You will be rewarded a maximum of 2 MRA grants for each fiscal year. To be eligible for this grant, you need to:

- Be registered or incorporated in Singapore;

- Have at least 30% local shareholder;

- Have a group annual turnover not exceeding S$100 million per year based on most recent audit report or group employment not exceeding 200 employees.

Current Support Level

Up to 70 per cent of qualifying costs, including identifying business partners and setting up overseas.

New Support Level

Up to 80 per cent of qualifying costs from 1 Nov 2020 to 30 Sept 2021. Will also cover participation in virtual trade fairs from 1 Nov 2020.

Enterprise Development Grant

The Enterprise Development Grant helps Singapore companies grow and transform. This grant funds qualifying project costs namely third party consultancy fees, software and equipment, and internal manpower cost. To qualify for this grant, you need to:

- Be a business entity registered and operating in Singapore

- Have a minimum of 30% local shareholding

- Be in a financially viable position to start and complete the project

Current Support Level

Up to 80 per cent of qualifying costs until 31 Dec 2020.

New Support Level

Higher support of up to 80 per cent extended by nine months to 30 Sept 2021, after which it will revert to up to 70 per cent.

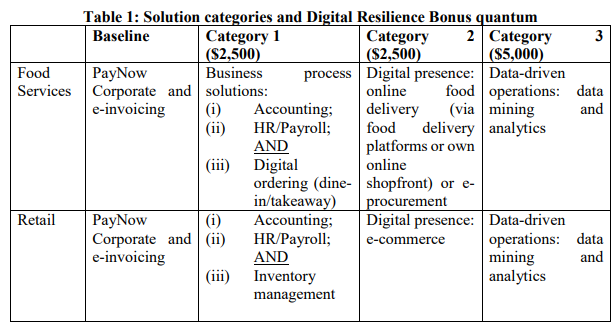

Productivity Solutions Grant

The Productivity Solutions Grant (PSG) supports companies keen on adopting IT solutions and equipment to enhance business processes.

For a start, PSG covers sector-specific solutions including the retail, food, logistics, precision engineering, construction and landscaping industries. Other than sector-specific solutions, PSG also supports adoption of solutions that cut across industries, such as in areas of customer management, data analytics, financial management and inventory tracking.

To help enterprise implement COVID-19 business continuity measures, the scope of generic solutions has expanded to include:

- Online collaboration tools (including laptop-bundled remote working solutions);

- Virtual meeting and telephony tools;

- Queue management systems;

- Temperature screening solutions

SMEs can apply for PSG if they meet the following criteria:

- Registered and operating in Singapore

- Purchase/lease/subscription of the IT solutions of equipment must be used in Singapore

- Have a minimum of 30% local shareholding; with Company’s group annual sales turnover less than S$100 million, OR less than 200 employers (selected solutions only)

Current Support Level

Up to 80 per cent of qualifying costs until 31 Dec 2020.

New Support Level

Higher support of up to 80 per cent extended by nine months to 30 Sept 2021, after which it will revert to up to 70 per cent.

Temporary Bridging Loan Programme

The Temporary Bridging Loan Programme (TBLP) allows eligible enterprises to borrow up to S$5 million, with a repayment period of up to 5 years.

Under the scheme, interest rates charged by Participating Financial Institutions (PFIs) are capped at a maximum interest rate of 5% per annum.

To be eligible for TBLP, you need to:

- Be a business entity that is registered and physically present in Singapore;

- At least 30% local equity held directly or indirectly by Singaporean(s) and/or Singapore PR(s), determined by the ultimate individual ownership

Current Support Level

Loans of up to $5 million, with up to 90 per cent risk-sharing by the Government until 31 March 2021.

New Support Level

Loans of up to $3 million, with up to 70 per cent risk-sharing by the Government from 1 April to 30 Sept 2021.

Enterprise Financing Scheme - Project Loan

This programme helps enterprises finance the fulfillment of secured overseas projects.

The supportable loan types include:

- Working Capital and Trade Loans

- Equipment/ Machineries/ Vessels/ Other fixed assets

- Guarantees

To be eligible for this loan, you are:

- A Singaporean SME looking to finance the fulfilment of secured overseas projects.

You need to:

- Be a business entity that is registered and physically present in Singapore.

- Have at least 30% local equity held directly or indirectly by Singaporean(s) and/or Singapore PR(s), determined by the ultimate individual ownership,

- Have a Maximum Borrower Group revenue cap of S$500 million for all companies…

Current Support Level

Loans of up to $50 million for secured overseas projects, with at least 50 per cent risk-sharing by the Government.

New Support Level

Expanded to allow construction companies to take up loans of up to $30 million for secured domestic projects, with at least 50 per cent risk-sharing by the Government, starting from 1 Jan 2021.

Enterprise Financing Scheme - Trade Loan

Finance trade needs, including:

- Inventory / stock financing

- Structures pre-delivery working capital (revolving working capital)

- Factoring (with recourse) /bill of invoice/ AR discounting

- Overseas working capital loan

- Bank Guarantee (capped at 2 years tenure)

Eligibility:

- Be a business entity that is registered and physically present in Singapore, and

- At least 30% local equity held directly or indirectly by Singaporean(s) and/or Singapore PR(s), determined by the ultimate individual ownership, and

- Have Group Annual Sales Turnover of not more than S$500 million

Current Support Level

Loans of up to $10 million, with up to 90 per cent risk-sharing by the Government until 31 March 2021.

New Support Level

Loans of up to $10 million, with up to 70 per cent risk-sharing by the Government from 1 April to 30 Sept 2021.