Supporting Businesses

Singapore Global Enterprise Initiative

The Singapore Global Enterprises initiative helps promising companies with customised assistance in areas such as innovation, internationalisation and fostering of partnerships with other companies, will receive a S$1 billion shot in the arm in Budget 2023.

Promising companies will be offered specialised capability building programmes tailored to their needs. This could involve working with experts to strengthen the core leadership team, accelerate their internationalisation plans, and build a strong talent pipeline.

Enterprise Singapore will also support companies to secure resources to execute their growth plans, and to build sustained research and innovation capabilities so as to strengthen their value proposition and stay competitive.

More information can be found here:

SME Co-Investment Fund

Government will set aside additional $150 million via SME Co-Investment Fund to invest in promising SMEs.

The Programme aims to catalyse the supply of patient growth capital for growth-oriented SMEs based in Singapore, through co-investing with the private sector.

The Government, as co-investor, would rely principally on the private sector fund managers to assess investment worthiness, so as to avoid eroding commercial discipline in investment decisions.

Private equity fund managers (“Fund Managers”) with experience in SME investing and the ability and aspiration to grow Singapore-based SMEs into globally competitive companies are invited to submit a proposal.

National Productivity Fund

Government will top up $4 billion to National Productivity Fund and expand scope to support investment promotion as a supportable activity.

The fund will be used to anchor more quality investments in Singapore. This includes supporting companies to build new capabilities, add greater value to our domestic ecosystems, and upskill our workers. Ultimately, these efforts will lead to better-paying jobs for Singaporeans.

Enterprise Innovation Scheme

The following suite of tax measures will be enhanced or introduced under the Enterprise Innovation Scheme to encourage businesses to engage in research and development (R&D), innovation, and capability development activities.

(A) Enhanced Tax Deduction for Staff Costs and Consumables Incurred on Qualifying R&D Projects Conducted in Singapore

Currently, businesses enjoy a 100% tax deduction for all qualifying R&D expenditure incurred on qualifying R&D projects, and an additional 150% tax deduction for staff costs and consumables incurred on qualifying R&D projects conducted in Singapore.

Announced in Budget 2023, the enhanced tax deduction will allow businesses to enjoy a 400% tax deduction for the first $400,000 of staff costs and consumables incurred on qualifying R&D projects conducted in Singapore for each Year of Assessment (YA) from YA2024 to YA2028.

All other existing eligibility criteria and conditions for tax deductions on staff costs and consumables incurred on qualifying R&D projects conducted in Singapore are applicable to the enhancement.

(B) Enhanced Tax Deduction for Qualifying Intellectual Property (IP) Registration Costs

Currently, businesses enjoy a 200% tax deduction on the first $100,000 of qualifying IP registration costs on registration of patents, trademarks, designs, and plant varieties. Subsequent qualifying IP registration costs can enjoy a 100% tax deduction.

Announced in Budget 2023, the enhanced tax deduction will allow businesses to enjoy a 400% tax deduction for the first $400,000 of qualifying IP registration costs incurred for each YA from YA2024 to YA2028.

All other existing eligibility criteria and conditions for tax deductions on qualifying IP registration costs are applicable to the enhancement.

(C) Enhanced Tax Allowance/Deduction for Acquisition and Licensing of Qualifying IP Rights

Under existing tax measures for IP rights, companies and partnerships can enjoy a 100% writing-down allowance on capital expenditure incurred on the acquisition of qualifying IP rights. Businesses can enjoy a 200% tax deduction on the first $100,000 of qualifying expenditure on licensing of qualifying IP rights. Subsequent expenditure on licensing of qualifying IP rights can qualify for a 100% tax deduction.

Announced in Budget 2023, the enhancement will allow businesses to enjoy tax allowances/deductions of 400% for the first $400,000 of qualifying expenditure incurred on the acquisition and licensing of qualifying IP rights for each YA from YA2024 to YA2028. The expenditure cap of $400,000 is applied across IP rights acquisition and licensing collectively. The enhancement will only be available to businesses that generate less than $500 million in revenue in the relevant YA.

All other existing eligibility criteria and conditions for tax allowances/deductions on acquisition and licensing of qualifying IP rights are applicable to the enhancement.

(D) Enhanced Tax Deduction for Qualifying Training Expenditure

Today, businesses can claim a 100% tax deduction on training expenditure as a deductible business expense.

Announced in Budget 2023, the enhancement will allow businesses to enjoy a tax deduction of 400% for the first $400,000 of qualifying training expenditure incurred for each YA from YA2024 to YA2028.

The enhancement is only applicable to qualifying training expenditure incurred on courses that are eligible for SkillsFuture Singapore funding and aligned with the Skills Framework. The list of courses that are eligible is available on go.gov.sg/eis-training.

All other existing eligibility criteria and conditions for tax deductions on training expenditure are applicable to the enhancement.

(E) Introduce Tax Deduction for Innovation Projects Carried Out with Polytechnics, the Institute of Technical Education (ITE) or Other Qualified Partners

To encourage businesses to kickstart their innovation journey by tapping on existing technical and innovation capabilities within the polytechnics, the ITE or other qualified partners (collectively termed as partner institutions), the Government will introduce a new tax deduction where businesses can claim a 400% tax deduction for up to $50,000 of qualifying innovation expenditures incurred on qualifying innovation projects carried out with partner institutions for each YA from YA2024 to YA2028.

The current list of partner institutions include:

a) Singapore Polytechnic

b) Ngee Ann Polytechnic

c) Republic Polytechnic

d) Nanyang Polytechnic

e) Temasek Polytechnic

f) The Institute of Technical Education

g) Precision Engineering Centre of Innovation at A*STAR SIMTech

Qualifying innovation projects with partner institutions refer to projects that predominantly involve one or more of the following innovation activities:

a) Research and experimental development activities;

b) Engineering, design, and other creative work activities;

c) IP-related activities; and

d) Software development and database activities.

The relevant partner institutions will validate the project as a qualifying innovation project and issue the innovation project invoice. Expenditure incurred outside of the collaboration with the partner institution will not qualify for this tax deduction.

(F) Cash Conversion

Eligible businesses can opt for a non-taxable cash payout at a cash conversion ratio of 20% on up to $100,000 of total qualifying expenditure across all qualifying activities (described under (A) to (E) above) for each YA, in lieu of tax deductions/allowances. The cash payout will be capped at $20,000 per YA. Applications for the cash payout are to be submitted together with the filing of the businesses’ income tax returns.

Eligible businesses refer to companies, registered business trusts, partnerships and sole-proprietorships with at least three full-time local employees (Singapore Citizens or Permanent Residents who are paid CPF contributions) earning a gross monthly salary of at least $1,400, in employment for six months or more, in the basis period of the relevant YA.

Supporting Workers

Jobs-Skills Integrators

Pilot Jobs-Skills Integrators in Precision Engineering, Retail, and

Wholesale Trade sectors to bring together key players to develop

industry-relevant training and facilitate job matching.

Progressive Wage Credit Scheme

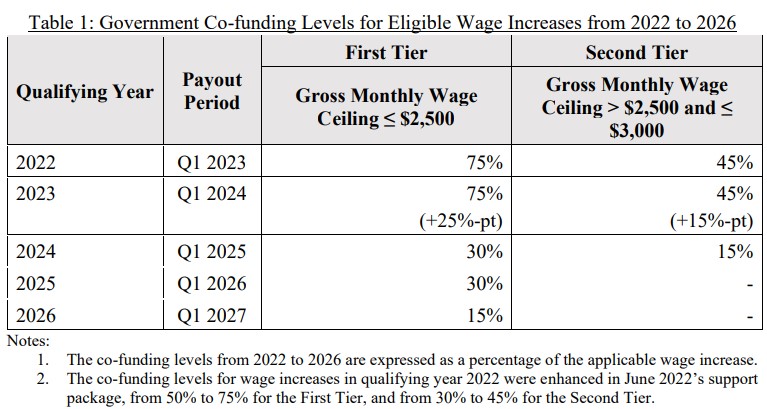

To further strengthen support for employers in uplifting lower-wage employees, the Government will enhance PWCS co-funding support for wage increases in the qualifying year 2023 (see Table 1). The enhanced 2023 co-funding support will also apply to wage increases given in qualifying year 2022 and sustained in 2023. All other scheme parameters remain unchanged.

Senior Employment Credit (SEC)

Under the SEC, the Government provides wage offsets to help employers that employ Singaporean workers aged 55 and above adjust to the higher Retirement Age and Re-employment Age. The SEC will be extended from 2023 to 2025 to continue providing wage offsets, and encourage employers to offer flexible work arrangements and structured career planning.

Details to be announced at MOM’s Committee of Supply (COS) 2023.

Part-time Re-employment Grant

The Part-time Re-employment Grant (PTRG) helped to increase the availability of part-time re-employment to senior workers in participating companies. The Part-time Re-employment Grant will be extended to 2025 to continue providing wage offsets, and encourage employers to offer flexible work arrangements and structured career planning.

Details to be announced at MOM’s Committee of Supply (COS) 2023.

Enabling Employment Credit (EEC)

To encourage more employers to hire persons with disabilities, the EEC will be enhanced to cover a larger proportion of wages and a longer duration for PwDs who have not been working for at least six months.

Details to be announced at MOM’s Committee of Supply (COS) 2023.

Uplifting Employment Credit

The Uplifting Employment Credit is a hiring incentive that encourages firms to employ ex-offenders, so as to support their reintegration into

society.

Details to be announced at MOM’s Committee of Supply (COS) 2023.

CPF Transition Support for Platform Workers

To improve the retirement and housing adequacy of Platform Workers (PWs), in November 2022, the Government accepted the Advisory Committee on Platform Workers’ (“the Committee”) recommendation to align CPF contribution rates by PWs and Platform Companies with the rates of employees and employers respectively (“Aligned CPF Contribution Rates”), over a phase-in period of five years.

PWs from mandatory cohorts as well as PWs who choose to opt in to the Aligned CPF Contribution Rates will see the additional CPF contributions from Platform Companies go towards their total earnings. The alignment will boost their savings in their CPF Ordinary and Special Accounts (CPF-OSA), so that they have more for retirement, and can finance their housing loans using CPF instead of cash. At the same time, the Committee recognised that some of these PWs might experience a reduction in take-home pay as they contribute more to their CPF accounts, and therefore recommended that the Government consider providing support for PWs to ease the impact.

Government Introduces the PW CPF Transition Support Scheme in Budget 2023

In line with the Committee’s recommendation, the Government will introduce the PW CPF Transition Support (PCTS) to provide support for lower-income PWs during the phase-in period. The PCTS will offset part of the PW’s share of the year-on-year increase in CPFOSA contribution rates from Years 1 to 4. Singaporean PWs earning $2,500 or less per month (including from platform work and other employment sources) will be eligible if they are required to or opt in to make contributions based on the Aligned CPF Contribution Rates.

More details about the PCTS will be announced at the Ministry of Manpower’s Committee of Supply 2023.

Changes to CPF Contribution Rates

The following Budget 2023 initiatives will help enhance the retirement adequacy of seniors who are preparing for or are already in retirement, and help middle-income Singaporeans to save more for retirement.

(A) Increase in Senior Worker CPF Contribution Rates

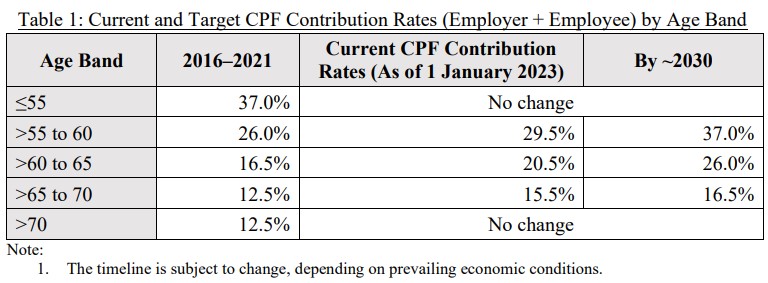

In 2019, the Government announced that CPF contribution rates will be raised gradually over the next decade or so for Singaporean and Permanent Resident workers aged above 55 to 70 (see Table 1). When the increases have been fully implemented, those aged above 55 to 60 will have the same CPF contribution rates as younger workers.

The first two steps of increases took effect on 1 January 2022 and 1 January 2023. The next increase in senior worker CPF contribution rates will take place on 1 January 2024, as shown in Table 2. As with previous increases, this increase will be fully allocated to the Special Account, to help senior workers save more for retirement.

To mitigate the rise in business costs due to this increase, as part of Budget 2023, the Government will provide employers with a one-year CPF Transition Offset equivalent to half of the 2024 increase in employer CPF contribution rates for every Singaporean and Permanent Resident worker they employ aged above 55 to 70 (see Table 2). This will be provided automatically and employers do not need to apply for the offset.

(B) Increase in Minimum CPF Monthly Payouts for Seniors on the RSS

The Government continues to provide targeted support for seniors with less resources to rely on in retirement. The Silver Support Scheme, which covers a third of all seniors aged 65 and above, provides quarterly cash supplements of up to $900 to eligible seniors in addition to their CPF payouts and other forms of Government support, such as the Workfare Income Supplement and ComCare. Many seniors also receive additional retirement support from their loved ones and from their private savings.

Currently, the minimum CPF monthly payout that seniors on the RSS1 can receive is $250. As part of Budget 2023, the Government will raise the minimum CPF monthly payout to $350 from 1 June 2023 for all seniors on the RSS. This will mean higher monthly payouts for seniors who are currently receiving less than $350 per month. Payouts will continue until CPF savings are depleted. These seniors on the RSS can opt to join CPF LIFE any time before turning age 80 to receive lifelong payouts.

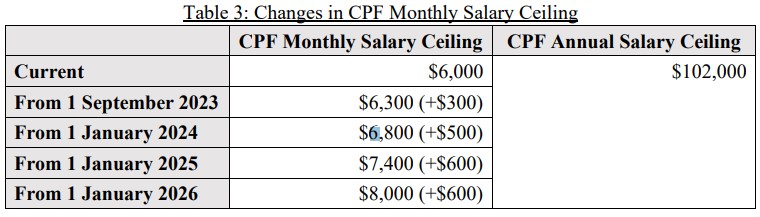

(C) Increase in the CPF Monthly Salary Ceiling

The CPF monthly salary ceiling sets the maximum amount of CPF contributions payable for Ordinary Wages, and is currently set at $6,000. There is also the CPF annual salary ceiling which sets the maximum amount of CPF contributions payable for all wages received in the year, inclusive of both Ordinary Wages and Additional Wages. It is currently set at 17 times of the monthly salary ceiling to account for bonuses equivalent to five months’ salary, and is currently set at $102,000. Both salary ceilings were last updated in 2016.

To keep pace with rising salaries, as part of Budget 2023, the Government will raise the CPF monthly salary ceiling from $6,000 to $8,000 by 2026. The increase will take place in four steps, as shown in Table 3, to allow employers and employees to adjust to the changes.

There will be no change to the CPF annual salary ceiling at this juncture, but it will be reviewed periodically to ensure it continues to cover the broad majority of CPF members.

To ensure that employees earning the same annual salary receive the same CPF contributions regardless of their salary structure, the CPF monthly salary ceiling will eventually be set at one-twelfth of the CPF annual salary ceiling at steady state.

Measures To Encourage Philanthropy And Volunteerism

The following Budget 2023 measures aim to foster a culture of giving in Singapore by encouraging philanthropy and volunteerism.

(A) Extension of the 250% Tax Deduction for Qualifying Donations to Institutions of a Public Character (IPCs) and Eligible Institutions

To continue to encourage giving, the Government will extend the 250% tax deduction for qualifying donations made to IPCs and other eligible institutions (see Table 1) for another three years, i.e., for donations made during the period 1 January 2024 to 31 December 2026 (both dates inclusive).

(B) Enhancement of the Corporate Volunteer Scheme.

The Business and IPC Partnership Scheme (BIPS) provides businesses with 250% tax deduction on wages and qualifying expenses when their staff volunteer, provide services, or are seconded to IPCs. The qualifying expenditure is subject to an annual cap of $250,000 per business, and $50,000 per IPC.

BIPS is due to lapse after 31 Dec 2023. BIPS will be enhanced into a broader Corporate Volunteer Scheme, and extended for three more years to 31 December 2026. In addition, the following enhancements will be made with effect from 1 January 2024. First, the scope of qualifying volunteering activities will be expanded to include activities which are conducted virtually (e.g., online mentoring and tuition support for youths/children) or outside of the IPCs’ premises (e.g., refurbishment of rental flats). Second, the cap on qualifying expenditure per IPC will be doubled from $50,000 to $100,000 per calendar year. All other conditions of the scheme will remain the same.

Global Anti-Base Erosion (GloBE) Rules (I.E., Income Inclusion Rule And Undertaxed Profits Rule) And Domestic Top-Up Tax (DTT)

Existing Tax Treatment

In Budget 2022, Minister for Finance announced that in response to the global minimum effective tax rate under the Pillar 2 GloBE rules of the Base Erosion and Profit Shifting (BEPS) 2.0 project, and based on consultation with industry stakeholders, MOF would study the introduction of a top-up tax. If introduced, this would top up the effective tax rate of multinational enterprises operating in Singapore with annual group revenue of at least €750 million, as reflected in the consolidated financial statements of the ultimate parent entity, to 15%.

New Tax Treatment

Singapore plans to implement the GloBE rules and DTT from businesses’ financial year starting on or after 1 January 2025. We will continue to monitor the international developments and adjust our implementation timeline as needed if there are delays internationally.

We will also continue to engage businesses and provide them with sufficient notice ahead of any rules becoming effective.

Enterprise Innovation Scheme (EIS)

Existing Tax Treatment

Currently, the following tax measures are available to

encourage research and development (R&D),

intellectual property (IP) registration, IP rights

acquisition and IP rights licensing:

a) 250% tax deduction for staff costs and consumables incurred on qualifying R&D projects conducted in Singapore under sections 14C and 14D of the Income Tax Act 1947(ITA). Current sunset date is Year of Assessment (YA) 2025.

b) 200% tax deduction for the first $100,000 (and 100% for amounts exceeding $100,000) of qualifying IP registration costs under section 14A of the ITA. Current sunset date is YA2025.

c) 100% writing-down allowance (WDA) over a period of five, 10 or 15 years on acquisition cost of qualifying IP rights under section 19B of the ITA. Current sunset date is YA2025.

d) 200% tax deduction for the first $100,000 (and 100% for amounts exceeding $100,000) of qualifying IP rights licensing expenditure under sections 14 or 14C, and 14U of the ITA. Current sunset date for section 14U is YA2025. In addition, 100% tax deduction can be claimed for training expenditure incurred, subject to the general tax deduction rules under sections 14 and 15 of the ITA.

New Tax Treatment

To encourage businesses to engage in R&D, innovation and capability development activities, the following suite of tax measures will be enhanced or introduced under the EIS:

a) Enhance the tax deduction to 400% for the first $400,000 of staff costs and consumables incurred on qualifying R&D

projects conducted in Singapore for each YA from YA2024 to YA2028.

b) Enhance the tax deduction to 400% for the first $400,000 of qualifying IP registration

costs incurred per YA from YA2024 to YA2028.

c) Enhance the tax allowance/deduction to

400% for the first $400,000 (combined cap) of qualifying expenditure incurred on

the acquisition and licensing of IP rights per YA from YA2024 to YA2028. This enhancement will only be available to businesses that generate less than $500

million in revenue in the relevant YA.

d) Enhance the tax deduction to 400% for the first $400,000 of qualifying training expenditure incurred on qualifying courses

(i.e. courses that are eligible for SkillsFuture Singapore funding and aligned with the Skills Framework) per YA from YA2024 to YA2028.

e) Introduce a 400% tax deduction for up to $50,000 of qualifying innovation expenditure incurred on qualifying innovation projects carried out with polytechnics, the Institute of Technical Education, and other qualified partners per YA from YA2024 to YA2028.

f) Allow businesses to, in lieu of tax deductions/allowances, opt for a non-taxable cash payout at a cash conversion ratio of 20% on up to $100,000 of total qualifying expenditure across all qualifying activities in (a) to (e) above per YA. The cash payout option will be capped at $20,000 per YA, and will only be available to businesses which have at least three full-time local employees (Singapore Citizens or Permanent Residents with CPF contributions) earning a gross monthly salary of at least $1,400 in employment for six months or more in the basis period of the relevant YA.

g) The sunset dates for section 14A (Deduction for costs of protecting IP), section 14C (Deduction for qualifying expenditure on R&D), section 14D (Enhanced deduction for qualifying expenditure on R&D), section 14U (Enhanced deduction for expenditure on licensing IP rights) and section 19B (WDA for capital expenditure on acquiring IP rights) of the ITA will be extended till YA2028, in line with the above enhancements.

All other conditions under sections 14A, 14C, 14D, 14U and 19B of the ITA remain the same.

For more information on this scheme, please refer to Annex D-1 IRAS will also provide further details of the changes by 30 June 2023.

Enhance Double Tax Deduction For Internationalisation (DTDi) Scheme

Existing Tax Treatment

Under the DTDi scheme, businesses are allowed a tax deduction of 200% on qualifying market expansion and

investment development expenses, subject to prior

approval from Enterprise Singapore (EnterpriseSG) or

Singapore Tourism Board (STB).

The DTDi scheme is in place until 31 December 2025.

New Tax Treatment

E-commerce is an increasingly important and relevant mode of overseas expansion for businesses. To support businesses in their efforts to overcome initial challenges and build up capabilities in internationalising via e-commerce, the scope of the DTDi scheme will be enhanced to include a new qualifying activity “e-commerce campaign” and cover the following e-commerce campaign startup expenses paid to e-commerce platform/service providers:

a) Business advisory: Advisory on market promotion and execution plans (e.g. choice of suitable e-commerce platforms);

b) Account creation: Assistance with setting up accounts on e-commerce platforms, and the right to sell on e-commerce platforms;

c) Content creation: Design of e-commerce campaign publicity materials (e.g. e-store banners, online product images); and

d) Product listing and placement: Uploading content on products/services to ecommerce platforms, and selection of suitable frequency and timing to display content on products/services. Prior approval is required from EnterpriseSG to enjoy DTDi on the new qualifying activity. For each business, EnterpriseSG will only approve DTDi support for e-commerce campaigns for a maximum period of one year applied on a per country basis. The above enhancement will take effect for qualifying e-commerce campaign startup expenses incurred on or after 15 February 2023.

EnterpriseSG will provide further details of the changes by 28 February 2023.

Option to Accelerate the Write-off of the Cost of Acquiring Plant and Machinery (P&M)

Existing Tax Treatment

Businesses that incur capital expenditure on the acquisition of P&M may claim capital allowance (CA) under section 19 (i.e. write-off over the working life of the assets as specified in the Sixth Schedule) or section 19A (i.e. write-off over one or three years) of the ITA.

New Tax Treatment

To provide temporary broad-based support to businesses during this period of restructuring, businesses that incur capital expenditure on the acquisition of P&M in the basis period for YA2024 (i.e. financial year ending in 2023) will have an option to accelerate the write-off of the cost of acquiring such P&M over two years. This option, if exercised, is irrevocable.

The rates of accelerated CA allowed are as follows:

a) 75% of the cost incurred to be written off in the first year (i.e. YA2024); and

b) 25% of the cost incurred to be written-off in the second year (i.e. YA2025). The above option will be in addition to the options

currently available under sections 19 and 19A of

the ITA. No deferment of CA claims is allowed under the

above option. This means that if a business opts for the accelerated write-off option, it needs to claim the capital expenditure incurred for acquiring P&M based on the rates of 75% (in YA2024) and 25% (in YA2025) over the two

consecutive YAs.

Provide Option to Accelerate Deduction for Renovation or Refurbishment (R&R) Expenditure

Existing Tax Treatment

Under section 14N of the ITA, businesses that incur qualifying expenditure on R&R may claim tax deduction on such expenditure over three consecutive YAs on a straight-line basis, starting from the YA relating to the basis period in which the R&R expenditure is incurred. A cap of $300,000 for every relevant period of the three consecutive YAs applies.

New Tax Treatment

To provide temporary broad-based support to businesses during this period of restructuring, businesses that incur qualifying expenditure on R&R during the basis period for YA2024 (i.e. financial year ending in 2023) will have an option to claim R&R deduction in one YA (i.e. accelerated R&R deduction). The cap of $300,000 for every relevant period of three

consecutive YAs will still apply. This option, if exercised, is irrevocable.

This option will be in addition to the existing option currently available under section 14N of the ITA.

Extend Investment Allowance (IA) Scheme

Existing Tax Treatment

The IA scheme provides an additional tax allowance for businesses which incur qualifying fixed capital

expenditure on approved projects. This is calculated as a percentage of the amount of capital expenditure incurred, net of grants, on an approved project.

The IA scheme, which is administered by the Singapore Economic Development Board, Building and Construction Authority, and EnterpriseSG, is scheduled to lapse after 31 December 2023.

New Tax Treatment

To continue encouraging businesses to make capital investments in plant and productive equipment in Singapore, the IA scheme will be extended till 31 December 2028.

Extend IA-100% Scheme for Automation Projects

Existing Tax Treatment

Businesses can enjoy 100% IA support on the amount of approved capital expenditure, net of grants, for automation projects approved by EnterpriseSG.

The IA-100% scheme is scheduled to lapse after 31 March 2023.

New Tax Treatment

To continue to encourage businesses to transform

through automation, the IA-100% scheme will be extended till 31 March 2026, with the same parameters.

Extend Pioneer Certificate Incentive (PC) and Development and Expansion Incentive (DEI)

Existing Tax Treatment

Both the PC and DEI aim to encourage companies to grow capabilities, conduct new or expanded economic activities, and establish their global or regional headquarters in Singapore.

a) Under the PC, recipients are eligible for corporate tax exemption on income from qualifying activities.

b) Under the DEI, recipients are eligible for concessionary tax rates of 5% or 10% on qualifying income.

The PC and DEI are scheduled to lapse after 31 December 2023.

New Tax Treatment

To continue encouraging companies to anchor and grow strategic high value-added manufacturing and services activities in Singapore, the PC and DEI will be extended till 31 December 2028.

Extend the IP Development Incentive (IDI)

Existing Tax Treatment

The IDI aims to support companies that use and

commercialise IP rights arising from R&D in Singapore. Under IDI, recipients are eligible for concessionary tax rates of 5% or 10% on a percentage of qualifying IP income.

The IDI is scheduled to lapse after 31 December 2023.

New Tax Treatment

To continue supporting the use and commercialisation of IP rights arising from R&D activities in Singapore, the IDI will be extended till 31 December 2028.

Extend and Refine Qualifying Debt Securities (QDS) Scheme

Existing Tax Treatment

The QDS scheme offers the following tax concessions on qualifying income from QDS:

a) 10% concessionary tax rate for qualifying companies and bodies of persons in Singapore;

and

b) Tax exemption for qualifying non-residents and qualifying individuals. To qualify as QDS, debt securities must be substantially arranged in Singapore as follows:

a) All debt securities must be substantially arranged by a financial sector incentive (capital

market) company or a financial sector incentive (standard tier) company (collectively referred to as “FSI company”); and

b) For insurance-linked securities (ILS)6 that are unable to meet the condition in (a) above, at least 20% of the ILS issuance costs incurred by the issuer is paid to Singapore businesses.

The QDS scheme is scheduled to lapse after 31 December 2023.

New Tax Treatment

To continue supporting the development of Singapore’s debt market, the QDS scheme will be extended till 31 December 2028.

The scope of qualifying income under the QDS scheme will be streamlined and clarified such that it includes all payments in relation to early redemption of a QDS. To ensure continued relevance, the requirement

that the QDS has to be substantially arranged in Singapore will be rationalised, as follows:

a) For all debt securities that are issued on or after 15 February 2023, they must be substantially arranged in Singapore by a

financial institution holding a specified licence (instead of a FSI company).

b) For ILS that are issued on or after 1 January 2024, if they are unable to meet the condition in (a) above, at least 30% of the ILS issuance costs incurred by the issuer must be paid to Singapore businesses.

All other conditions of the scheme remain the same. The Monetary Authority of Singapore (MAS) will provide further details by 31 May 2023.

Extend Tax Exemption on Income Derived by Primary Dealers from Trading in Singapore Government Securities(SGS)

Existing Tax Treatment

Tax exemption is granted on income derived by primary

dealers from trading in SGS.

The tax exemption is scheduled to lapse after 31 December 2023.

New Tax Treatment

To continue supporting primary dealers and encourage trading in SGS, the tax exemption on income derived by primary dealers from trading in SGS will be extended till 31 December 2028.

All other conditions of the scheme remain the same.

Extend and Refine Tax Incentive Scheme for Approved Special Purpose Vehicle (ASPV) Engaged in Asset Securitisation Transactions (ASPV scheme) and Introduce a New Sub-scheme to Support Covered Bonds

Existing Tax Treatment

The ASPV scheme grants the following tax concessions to an ASPV engaged in asset securitisation transactions:

a) Tax exemption on income derived by an ASPV from asset securitisation transactions;

b) Goods and Services Tax (GST) recovery on its qualifying business expenses at a fixed rate of 76%; and

c) Withholding tax (WHT) exemption on payments to qualifying non-residents on over-the-counter financial derivatives in connection with an asset securitisation transaction.

The ASPV scheme is scheduled to lapse after 31 December 2023.

New Tax Treatment

To continue developing the structured debt market, the ASPV scheme will be extended till 31 December 2028.

Instead of a fixed rate of 76%, the GST recovery rate will be the prevailing GST recovery

rate/methodology accorded to licensed full banks under MAS for the specific year in question.

All other tax concessions and conditions of the ASPV scheme remain the same. Further, to support the issuance of covered bonds in Singapore, a new sub-scheme named ASPV (Covered Bonds) will be introduced for the special purpose vehicle holding the “cover pool” in relation to the covered bonds as defined in MAS Notice 648.

The ASPV (Covered Bonds) scheme will take effect from 15 February 2023 to 31 December 2028 and will be administered by MAS.

MAS will provide further details by 31 May 2023.

Extend and Refine the Financial Sector Incentive (FSI) Scheme

Existing Tax Treatment

The FSI scheme accords concessionary tax rates of 5%, 10%, 12% and 13.5% on income from qualifying banking and financial activities, headquarters and corporate services, fund managing and investment advisory services.

The FSI scheme is scheduled to lapse after 31 December 2023.

New Tax Treatment

To continue supporting the growth of financial sector activities in Singapore, the FSI scheme will be extended and refined as follows:

a) The FSI scheme will be extended till 31 December 2028.

b) The existing concessionary tax rates will be streamlined to two tiers of 10% and 13.5% for new and renewal awards approved on or after 1 January 2024, as follows:

i) FSI-Capital Market, FSIDerivatives Market and FSICredit Facilities Syndication – from 5% to 10%;

ii) FSI-Fund Management and FSIHeadquarter Services –remain at 10%;

iii) FSI-Trustee Companies – from 12% to 13.5%; and

iv) FSI-Standard Tier – remain at 13.5%.

c) The qualifying activities will be updated to ensure continued relevance.

MAS will provide further details of the changes by 31 May 2023.

Extend Insurance Business Development – Insurance Broking Business (IBD-IBB) Scheme

Existing Tax Treatment

The IBD-IBB scheme grants approved insurance and

reinsurance brokers a concessionary tax rate of 10% on commission and fee income derived from insurance

broking and advisory services.

The IBD-IBB scheme is scheduled to lapse after 31 December 2023.

New Tax Treatment

To further strengthen Singapore’s position as a leading insurance and reinsurance centre, the IBD-IBB scheme will be extended till 31 December 2028.

All other conditions of the scheme remain the same.

Extend Tax Concession for Deduction of General Provisions for Doubtful Debts and Regulatory Loss Allowances Made in Respect of Non-credit impaired Financial Instruments for Banks (Including Merchant Banks) and Qualifying Finance Companies

Existing Tax Treatment

Under section 14G of the ITA, banks, merchant banks

and qualifying finance companies can claim a tax deduction for general provisions on non-credit impaired loans and debt securities made under the Financial Reporting Standard 109 or Singapore Financial Reporting Standard (International) 9, and any additional loss allowances as required under prevailing

MAS Notices, subject to a cap. The tax deduction under section 14G is scheduled to lapse after YA2024 (for banks, merchant banks and qualifying finance companies with a 31-December financial year end (FYE)) or YA2025 (for banks, merchant banks and qualifying finance companies with a non-31-December FYE).

New Tax Treatment

To continue to promote the overall robustness and stability of the Singapore financial system, the tax deduction under section 14G of the ITA will be extended till YA2029 (for banks, merchant banks, and qualifying finance companies with a 31-December FYE) or YA2030 (for banks, merchant banks, and qualifying finance companies with a non-31-December FYE).

Extend Three Tax Measures Relating to Submarine Cable Systems

Existing Tax Treatment

Currently, there are three tax measures relating to submarine cable systems:

a) WHT exemption on payments made to non-residents for use of international telecommunications submarine cable capacity under indefeasible right to use (IRU) agreements. This is scheduled to lapse after 31 December 2023.

b) WDA for the acquisition of an IRU over their useful life. This is scheduled to lapse after 31 December 2025.

c) IA for the construction and operation of submarine cable systems in Singapore.

This is scheduled to lapse after 31 December 2023.

New Tax Treatment

To maintain and enhance Singapore’s international connectivity, all three tax measures will be extended till 31 December 2028, with the same parameters.

Withdraw Tax Deduction for Expenditure Incurred on Building Modifications for Benefit of Disabled Employees

Existing Tax Treatment

Under section 14F of the ITA, employers can claim tax deductions for approved expenditure incurred on any addition or alteration to business premises for the purpose of facilitating the mobility or work of any disabled employee, subject to a one-off cap of $100,000.

New Tax Treatment

The scheme will be withdrawn from 15 February 2023.

Introduced in Budget 1989, the scheme has become less relevant over the years. Since then, other support schemes (e.g. the Open Door Programme Job Redesign Grant) have been introduced to help employers recruit and retain disabled employees, or to support employers for accommodations beyond (and including) physical modifications of the workplace. Section 14N on tax deductions for Renovation and Refurbishment, introduced in Budget 2008, can also be tapped upon for workplace modifications without the need for prior approval from government agencies.

Buyer's Stamp Duty and Additional Conveyance Duties for Buyers

Existing Tax Treatment

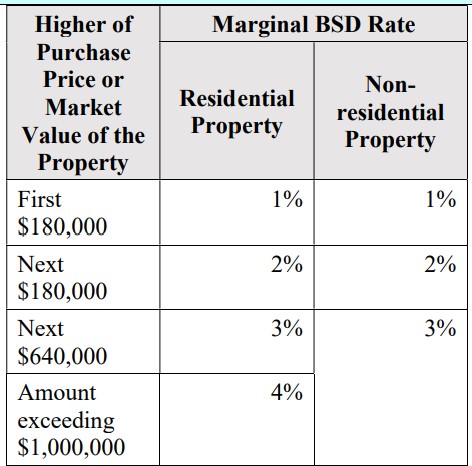

Currently, transactions in residential and non-residential properties are subject to marginal BSD rates of 1% to 4% and 1% to 3% respectively:

New Tax Treatment

To enhance the progressivity of our BSD regime, higher marginal BSD rates will be introduced for higher-value residential and non-residential properties.

For residential properties, a new marginal BSD rate of:

a) 5% will apply to the portion of the property value in excess of $1.5 million and up to $3 million;

and

b) 6% will apply to the portion of the property

value in excess of $3 million.

For non-residential properties, a new marginal BSD rate of:

a) 4% will apply to the portion of the property value in excess of $1 million and up to $1.5

million;

and

b) 5% will apply to the portion of the property value in excess of $1.5 million.

The revised rates will apply to all properties acquired on or after 15 February 2023.

Tobacco Excise Duty

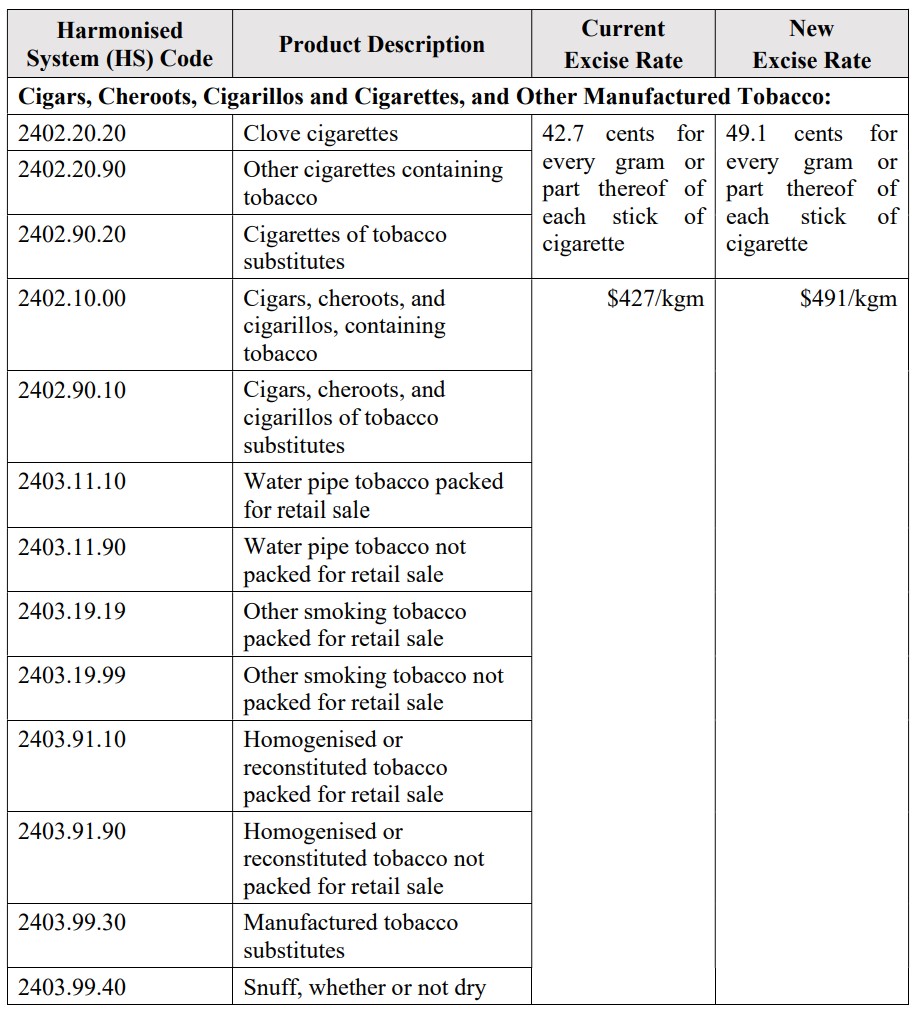

To discourage the consumption of tobacco products, we will raise the excise duties by 15% across all tobacco products. These tax changes will take effect on and after 14 February 2023:

(A) Cigars, Cheroots, Cigarillos and Cigarettes, and Other Manufactured Tobacco:

From $427/kgm or 42.7 cents/stick of cigarette to $491/kgm or 49.1 cents/stick of cigarette.

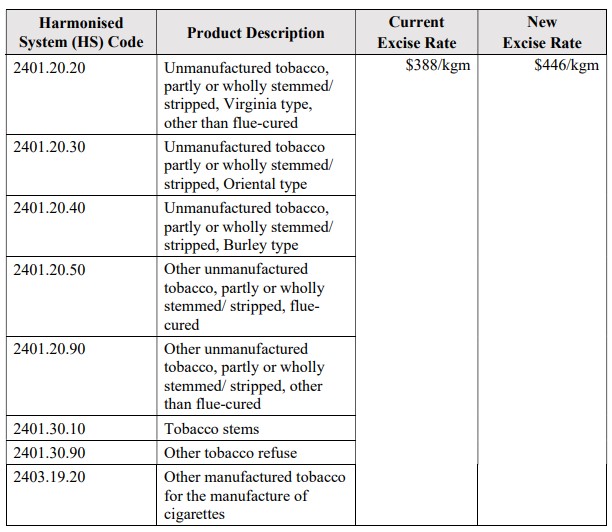

(B) Beedies, Ang Hoon, and Other Smokeless Tobacco:

From $329/kgm to $378/kgm.

(C) Unmanufactured and Cut Tobacco and Other Tobacco Refuse: From $388/kgm to $446/kgm.

Vehicular Tax Changes

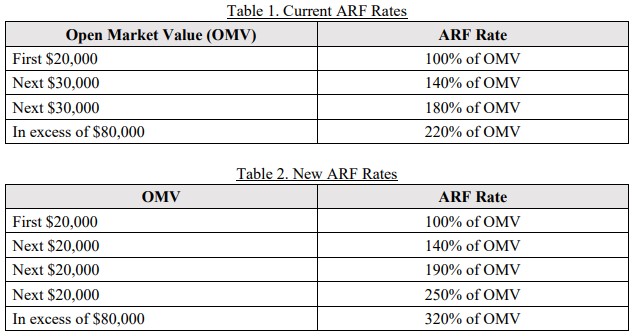

(A) Additional Registration Fee Changes

To make our vehicular tax structure more progressive, the following changes will be made to the Additional Registration Fee (ARF) payable for cars, taxis, and goods-cum-passenger vehicles (GPVs):

The new ARF structure will apply to all new and imported used cars and GPVs registered with Certificate of Entitlements (COEs) obtained from the second bidding exercise in February 2023 onwards. The second COE bidding exercise in February 2023 will take place from 20 to 22 February 2023.

For cars that do not need to bid for COEs (e.g. taxis, classic cars), the new ARF structure will apply for those registered on or after 15 February 2023.

(B) Preferential Additional Registration Fee Rebate Changes