Rules for Supplies that span the change of GST rate

A supply spans the change of GST rate where one or two of the following events takes place wholly or partially on or after 1 Jan 2023:

- the issuance of invoice;

- the receipt of payment (or the making of payment in respect of a reverse charge supply);

- the delivery of goods or performance of services.

Invoice issued on or after 1 Jan 2023

Full payment received before 1 Jan 2023 Goods delivered after 1 Jan 2023

If you issue an invoice for your supply on or after 1 Jan 2023 but you receive full payment before 1 Jan 2023, the supply is subject to 7% GST.

Full payment received after 1 Jan 2023 Goods delivered before 1 Jan 2023

If you issue an invoice for your supply on or after 1 Jan 2023 but you have delivered all the goods or performed all the services before 1 Jan 2023, the entire value of the supply is subject to 7% GST.

Invoice is issued before 1 Jan 2023

Full payment received or Goods delivered before 1 Jan 2023

If you have received full payment before 1 Jan 2023, or if you have delivered all the goods or performed all the services before 1 Jan 2023, the entire value of the supply is subject to 7% GST.

Partial payment received or partial goods delivered before 1 Jan 2023

If you do not receive full payment before 1 Jan 2023 and you have delivered or performed a part or all of the goods or services before 1 Jan 2023, you can elect to charge 7% GST on the higher of:

(a) The payment received is before 1 Jan 2023; or

(b) The value of goods delivered or services performed is before 1 Jan 2023.

The remaining value of the supply will be subjected to 8% GST.

Supply involving invoice issued before 1 Jan 2023 – full payment received after 1 Jan 2023

On 22 Dec 2022, you issue a tax invoice for your supply of services (value of $1,000) and you receive the full payment on 5 Jan 2023. You perform part of the services (value of $200) before 1 Jan 2023 and the remaining part of the services (value of $800) after 1 Jan 2023.

You must charge and account for GST at 7% ($70) for the tax invoice issued to your customer on 22 Dec 2022. As you do not receive any payment and only perform part of the services before 1 Jan 2023, under the transitional rules, you are required to issue the following to your customer by 15 Jan 2023, for that part of the services performed after 1 Jan 2023:

- a credit note for $856 ($800 plus 7% GST of $56); and

- a new tax invoice for $864 ($800 plus 8% GST of $64).

Supply involving invoice issued before 1 Jan 2023 – payments straddle 1 Jan 2023

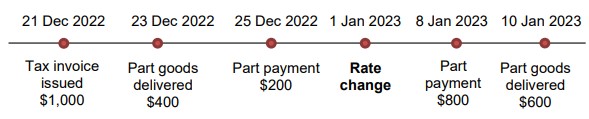

On 21 Dec 2022, you issue a tax invoice for your supply of services (value of $1,000). Before 1 Jan 2023, you delivered part of the goods (value of $400) and received a payment of $200. After 1 Jan 2023, you receive the remaining payment of $800 and perform delivered the other part of the goods (value of $600).

Under the transitional rules, you are required to issue the following by 15 Jan 2023, for that part of the goods delivered after 1 Jan 2023:

- a credit note for $642 ($600 plus 7% GST of $42); and

- a new tax invoice for $648 ($600 plus 8% GST of $48)